SFDR vs CSRD vs TCFD vs ESG

Oct 21, 2025

As sustainability regulation accelerates, investors are expected to disclose how their portfolios impact the planet—and how climate and social risks impact returns. For fund managers, that means understanding the key differences between SFDR, CSRD, TCFD, and ESG. Each plays a unique role in shaping modern finance.

This guide breaks down what each framework covers, who it applies to, and how to align compliance with opportunity.

SFDR vs CSRD

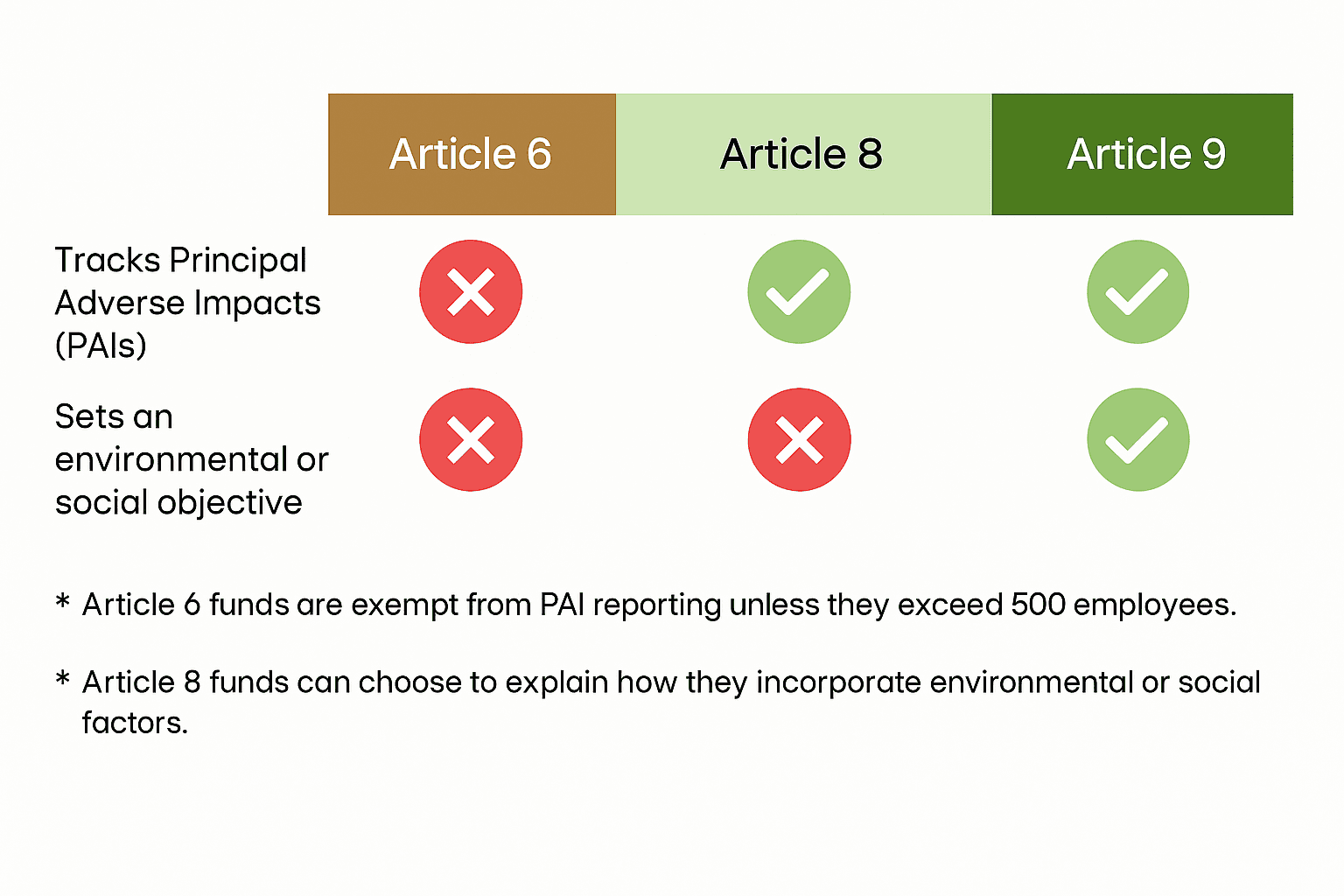

The Sustainable Finance Disclosure Regulation (SFDR) sets disclosure rules for financial institutions. It requires asset managers, private-equity firms, and other market participants to explain how they integrate sustainability risks and classify funds under three categories:

Article 6 – No sustainability objective

Article 8 – Promotes environmental or social characteristics

Article 9 – Main objective is sustainable investment

The Corporate Sustainability Reporting Directive (CSRD), in contrast, targets companies. It standardizes ESG reporting across Europe using the European Sustainability Reporting Standards (ESRS). Companies must report both how sustainability affects their business and how their business affects people and the planet — a principle known as double materiality.

What is the difference between CSRD and SFDR? CSRD generates the data; SFDR uses it. CSRD provides company-level ESG information that feeds into SFDR fund-level disclosures, creating a closed loop between corporate and investor reporting.

Difference Between SFDR and TCFD

The Task Force on Climate-Related Financial Disclosures (TCFD) was developed to help organizations report climate risk and opportunity in a structured way. It focuses on four pillars: governance, strategy, risk management, and metrics and targets.

TCFD vs SFDR comes down to scope. TCFD focuses solely on climate-related risks and financial exposure. SFDR covers all environmental, social, and governance factors for funds. Where TCFD asks “how will climate change affect returns,” SFDR asks “how does every sustainability factor shape this fund’s impact.”

The two are complementary. Many fund managers use TCFD’s structure to analyze climate scenarios, then report those findings under SFDR’s mandatory disclosures. As ISSB global standards build on TCFD, alignment now helps future-proof your reporting.

SFDR vs ESG

SFDR is a regulation. ESG is a framework for measuring performance.

ESG data covers environmental metrics like emissions and waste, social topics like labor and equity, and governance factors such as board structure and ethics. SFDR turns these factors into disclosure requirements so investors can compare funds on a like-for-like basis.

Think of ESG as the what and SFDR as the how. ESG defines the themes to measure; SFDR defines the rules for how to publish them to the market.

SFDR for Private Equity

For private equity funds, SFDR presents both challenge and opportunity. Unlike public markets, portfolio companies may lack consistent ESG data, so fund managers must establish reporting templates and collect metrics directly from each company.

Classifying funds as Article 8 or 9 requires evidence of how sustainability objectives are integrated throughout the investment cycle. That means documenting pre-investment due diligence, post-investment monitoring, and impact measurement at exit.

Many funds use SFDR disclosures as a differentiator when raising capital from European LPs. Strong ESG tracking builds credibility and signals alignment with institutional expectations.

SFDR for Non-EU Funds

Even funds outside the EU are feeling the pressure to align with SFDR. Limited partners in Europe increasingly require SFDR-style disclosures from global GPs before committing capital.

Adopting SFDR early offers three advantages:

Access to EU investors without regulatory friction.

Stronger internal data discipline across funds and geographies.

Better positioning as ESG standards converge globally.

For non-EU funds, alignment often starts with voluntary Article 8-style policies and principal adverse impact ( PAI ) tracking. This creates a baseline that can later expand to full compliance as investor demand grows.

Integrating Frameworks for Real Value

Each framework serves a different purpose:

SFDR – How funds disclose ESG performance.

CSRD – How companies report their own impact.

TCFD – How organizations analyze climate risk.

ESG – The metrics that underpin them all.

When used together, they form a coherent system for sustainable finance. SFDR and CSRD link investors and corporates. TCFD adds climate depth. ESG provides the common language. For fund managers, integrating these frameworks is no longer just compliance—it is a strategic advantage in capital raising and risk management.

Turning Compliance Into Opportunity

Sustainability reporting should not feel like a burden. It should be a competitive advantage. The most effective investors use transparency and data to sharpen strategy and build trust with LPs.

At Merivia.ai, we built a platform that adapts to how investors actually work. It connects data, performance, and reporting across every standard in one flexible system. Ask questions in natural language, run complex aggregations instantly, and turn raw inputs into clear evidence for LPs and regulators.

For modern fund managers, sustainability is part of every decision. Merivia.ai brings it all together so you can move faster, see clearly, and report with confidence. so you can move faster, measure better, and invest with confidence.

© 2025 Merivia, Inc. All rights reserved.